How to Provide Transaction Histories to Your Mortgage Loan Officer

Salomon Chong • December 6, 2018

Loan Officers work hard to get the most current, comprehensive view of your finances so—in addition to bank statements—they’ll often ask you to provide a transaction history. They need your transaction history for documentation of transactions that occurred after your most recent posted bank statement.

For example, let’s say you received your most recent bank statement on November 1st and that statement included all your transactions from the month of October. Now imagine it’s November 15th and you’re applying for a mortgage and the loan officer needs to see your past two months of financial activity.

You could provide them statements for the months of October and September, but what about the 15 days since your last statement?

That’s where your transaction history comes in.

Knowing why your loan officer needs your transaction history is a good first step. But now you need to know how to provide this documentation in the correct format and over the correct time period.

Selecting the Time Frame for Your Transaction History

You must pull your transaction history from the date of the last transaction line item on your most recent bank statement through to the present date.

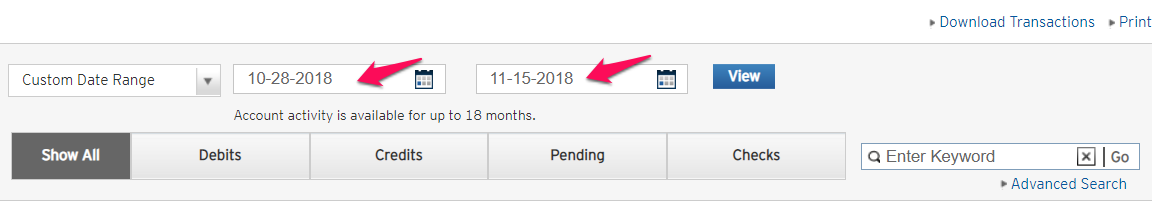

So, for example, if the last transaction on your bank statement is dated October 28th and today is the 15th of November, you’ll need to set the date range to October 28th through November 15th. You can do this by accessing your online banking portal and selecting a custom date range, as shown in the image below:

You must do it this way so the lender can see that the last transaction on your full bank statement matches the first line item on your transaction history.

Since a transaction history only shows the last 4 digits of your account number, matching the transaction history’s first line item with the bank statement’s last line item helps lenders verify that the transaction history is yours.

The Proper Way to Document Your Transaction History

To ensure the documents they’re receiving are legitimate, lenders will require you to provide your transaction history in a certain format. That means no screenshots.

Instead, you can use one of the following methods:

1. Print and Scan with a Traditional Scanner

After you’ve selected the date range for your transaction history, your online banking portal should give you the option to print your transaction history. Once you print it out, scan the document and attach it to an email to send to your loan officer.

2. Print and Scan with a Virtual Scanner

If you don’t have a scanner, follow the same steps you would with a traditional scanner but use a virtual scanner such as TinyScanner to scan the document. Then email it as an attachment.

3. Save as a PDF

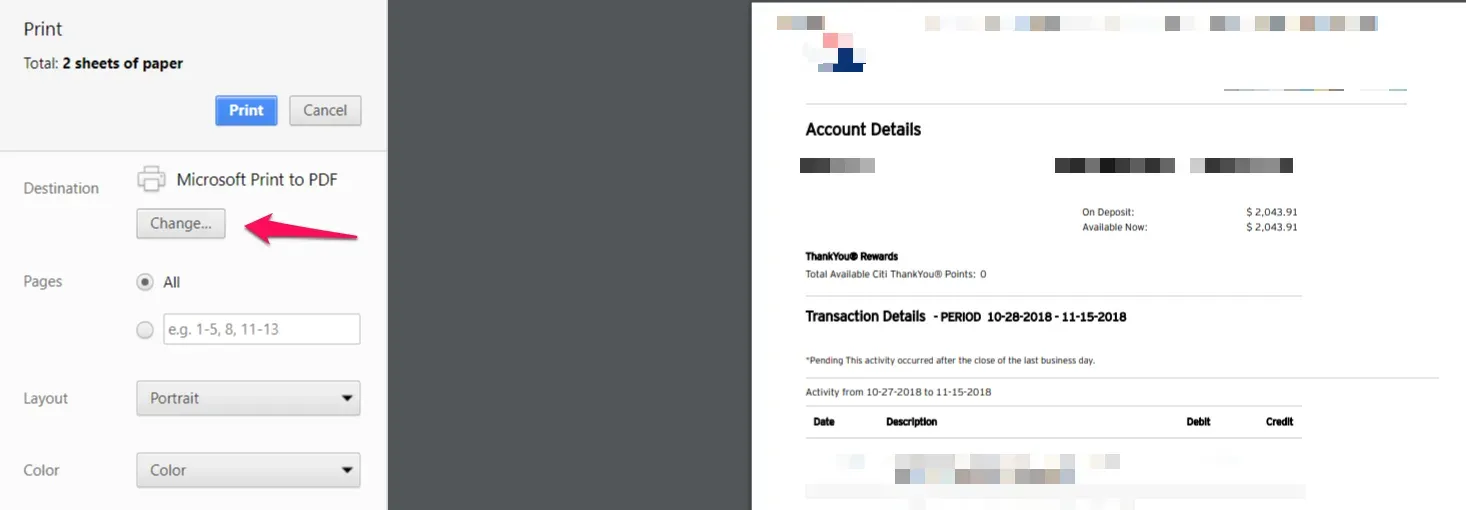

If you have the full version of Adobe, set the date range for your transaction history, select print, and adjust the print settings so that the destination of your print job reads “Print to PDF” or “Save as PDF” as shown in the image below:

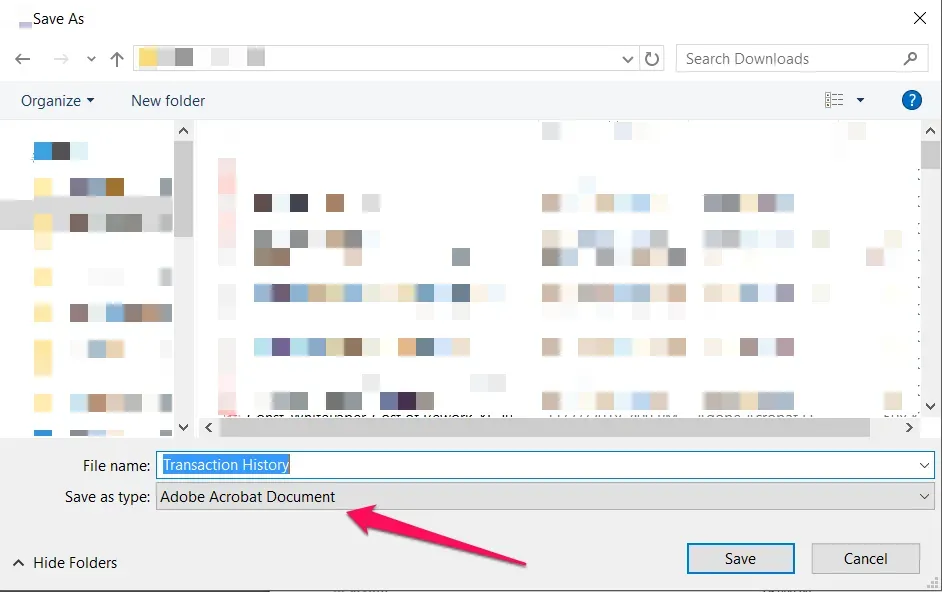

Whether your “Print to” or “Save as”, when you click “Print” you’ll be brought to the following screen (Mac users will see a slightly different screen):

Make sure to save the document as a PDF or—as the image above shows—an Adobe Acrobat Document. After saving the file, attach it to an email and send it.

4. Print and Take a Picture

You may also take a picture of the document with your phone. Just make sure that you place the document on a flat surface with contrast and ensure the full document is included in the image. Then, attach the image to an email and send it to your loan officer.

A Final Reminder on Transaction Histories with Large Deposits

If you notice that your transaction history includes irregularly large deposits, you may need to provide additional documentation to your mortgage loan officer to explain those deposits. Read our post on bank statement documentation for more details on the type of documentation you’ll need to verify your source of funds for a large deposit.

Call now at (888) 273-8734 or Schedule a Consultation to discuss how we can help.