Components of a Home Mortgage Rate: Interest, Points, and Loan Costs

Salomon Chong • September 24, 2020

Mortgage Rate Series Part 1: Understanding the Cost Components of a Mortgage Rate

The total cost of your mortgage is a combination of three factors: the upfront cost (a.k.a. “discount points”), interest rate, and other loan costs.

But your mortgage rate is actually a combination of just two of those factors: the upfront cost and the interest rate.

To accurately compare the cost of one loan versus another, you need to know and understand the relationship between these two costs. Then you can understand how other loan costs play into the equation.

So in this post, I’m going to explain the different components of a mortgage rate, starting with discount points and interest rates.

The Relationship Between Interest Rates and Discount Points

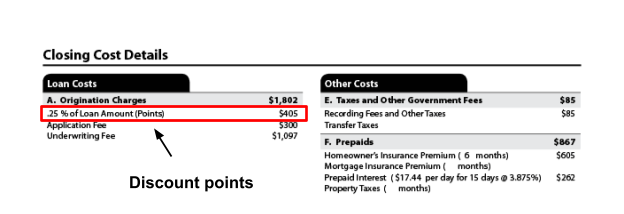

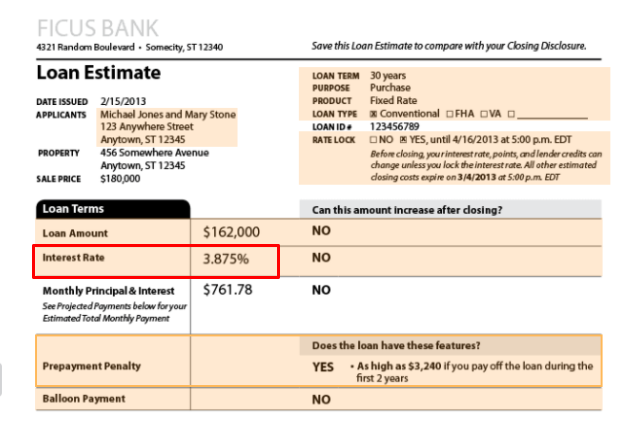

If you’re looking at a Loan Estimate, you can find the discount points on page 2, under “A. Origination Charges, “ and you can find your interest rate on page 1 under the “Loan Terms” header, as shown below:

And you can find your interest rate on page 1 under the “Loan Terms” header, as shown here:

To come up with your interest rate, mainstream lenders prepare tables of interest rates that they’re willing to accept on certain loans.

These interest rates are called “par rates”, which is the interest rate at which the lender will offer the loan without requiring the borrower to pay discount points.

Even if they’re not required to, borrowers can choose to purchase discount points to “buy down” the par rate. In other words, you can pay more upfront in exchange for a lower interest rate.

Sometimes, lenders will add discount points without you asking them to so their rates look lower. A simple way to avoid confusion here is to ask for a loan offer with zero discount points. Alternatively, you can use the mortgage annual percentage rate (APR) to make a fairer comparison between one loan with discount points and one without.

Why Should Homebuyers Care About Discount Points?

Using different combinations of discount points can be advantageous depending on your financial situation and the lender’s offer. For example, if you have extra cash and you plan on staying in your home for a long time, paying more discount points may save you money.

But keep in mind that there’s no standard amount by which one discount point reduces your rate. It may vary between lenders, based on the type of loan, and the mortgage market.

As NerdWallet points out, the rule of thumb is “the longer you keep the mortgage, the more money you save by buying points.”

You can do your own calculation using this calculator from NerdWallet to evaluate this decision using the following factors:

- Loan amount

- Loan term

- Interest rate with points

- Interest rate without points

- Number of points

The calculator’s results will tell you your breakeven period—which is the time it will take for you to start saving money from the lower interest rate. If you think you’ll refinance or sell your home before this breakeven period ends, you’re better off avoiding discount points.

Avoiding Confusion with Discount Points, Other Costs, and Fees

Remember: discount points change the timing and amounts that you pay for a mortgage. For example, you can elect to pay more upfront (in the form of discount points) in exchange for a lower interest rate over the life of your loan, and vice versa.

But discount points are not the same as the “Other Costs” you’ll see on page 2 of your Loan Estimate. Nor are they the same as the “Loan Costs” you’ll see on page 2 of your Loan Estimate in Sections B and C.

With some exceptions, “Other Costs” like taxes, homeowner’s insurance, recording fees, and mortgage insurance are typically standard. And whether you pay more or fewer “Other Costs” doesn’t affect your interest rate.

The “Loan Costs” on page 2, Sections B and C, may vary depending on the lender, but again, they don’t affect your interest rate… even though they do affect the total cost of your mortgage.

Comparing the Cost Components of Your Mortgage

It’s easy to get overwhelmed by the cost components of your mortgage. That’s essentially why APR was created. But APR has its limitations.

While APR does show you the total cost of your mortgage, it doesn’t tell you how much cash you’ll need to close a particular loan. Nor does it tell you how much you need to budget for monthly payments.

So if you want a true comparison of your mortgage options, make sure you understand how discount points, interest rates, and loan costs play into the equation. And if you need more help understanding or comparing your mortgage rates, schedule a free consultation with our loan experts.

Want to Keep Getting the Inside Scoop on Mortgage Rates?

This post is part one of a three-part series on mortgage rates.

I wrote this series to help homebuyers feel more confident in their financing by explaining (in plain English) the fundamentals of mortgage rates, starting with this post, which breaks down the cost components of a mortgage rate.

In parts two and three, I’ll explain how these costs are determined and why they change.

Next up in the series on mortgage rates is “The Fundamentals of Mortgage Rates: How They’re Determined and Why They Change.”

In that post, I pull the curtain back on the fundamental drivers of mortgage rates so you can get the insider’s perspective on mortgage rates and become a more educated, empowered home buyer.