How Different Property Occupancy Types Affect Your Mortgage Rate

Salomon Chong • September 15, 2020

Mortgage lenders don’t shy away from risk… so long as they can price that risk at a level that they can make a profit.

And pricing the risk of mortgages accurately requires careful analysis of many factors.

These factors may include—but aren’t limited to—your credit score, property type, debt-to-income ratio, down payment amount, and the occupancy type of the property you plan to purchase.

Why Occupancy Type Matters to Your Mortgage Cost

Occupancy type is important because it indicates to a lender the lengths to which a borrower will go before they give up making payments on their mortgage.

To understand this, imagine you own two properties, each with their own mortgage.

One property is your home, where your spouse or kids live, or where you spend most of your time. This is your principal residence. The other property is a duplex that you rent out. This is your investment property.

Now, imagine you faced a significant financial hardship, and you could only afford to keep making payments on one of your two mortgages.

Which property’s mortgage would you stop paying first?

Statistically, most people would stop making payments on the duplex’s mortgage (the investment property).

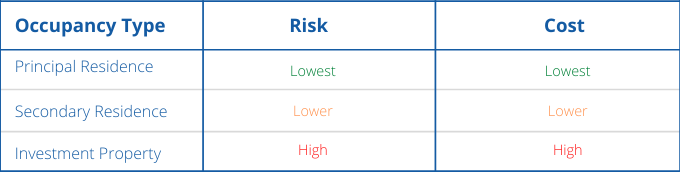

This is essentially why occupancy type matters to your mortgage cost. The market perceives more or less risk depending on the occupancy type, so it prices loans (in part) according to the occupancy type of the property you plan to finance.

All else being equal, the cost of your mortgage on an investment property will be higher than it will be on a principal residence.

However, there’s a third type of occupancy, the risk of which falls somewhere between an investment property and principal residence: the secondary residence.

For the same reason a mortgage on a principal residence is less risky (and therefore less costly) than an investment property mortgage, a secondary residence mortgage is less risky than an investment property mortgage.

The image below illustrates this hierarchy:

The 3 Property Occupancy Types Defined

Once you understand how occupancy type affects your mortgage cost, the next challenge is to remember their eligibility criteria.

When you talk to a mortgage broker or lender, you’ll want to be clear about which occupancy type your property will have. Of course, the broker or lender should be able to help you make this determination, but it always helps to be prepared.

The next few sections outline the definitions of the three property occupancy types.

Principal Residence

Fannie Mae and Freddie Mac define your principal residence as a one-to-four unit family home that you (as the borrower) occupy as your primary residence. You must occupy the property for the majority of each calendar year for it to be considered a principal residence for mortgage purposes.

In terms of documentation, your principal residence is the address listed on your federal and state tax return.

Second Home

Nolo explains that “A second home is a residence you intend to occupy in addition to a primary residence for part of the year.”

A second home is usually a vacation home, but it could also be a property you visit regularly. Below is a table that Fannie Mae provides with requirements for a property to be considered a second home.

| Second Home Requirements |

|---|

| must be occupied by the borrower for some portion of the year |

| is restricted to one-unit dwellings |

| must be suitable for year-round occupancy |

| the borrower must have exclusive control over the property |

| must not be rental property or a timeshare arrangement |

| cannot be subject to any agreements that give a management firm control over the occupancy of the property |

Investment Property

If you purchase a property you’re going to use to make and profit and you don’t plan to use it as a personal residence, it’s an investment property.

For example, if you plan to use a property for one month and rent it out the rest of the year, it’s considered an investment property. That said, in some cases, you can earn rental income on a property without it being considered an investment property.

However, you won’t be allowed to use that rental income for qualifying purposes and you’ll need to meet all other requirements for second homes.

Other Important Considerations Related to Occupancy Types

So far, I’ve talked about occupancy type as it relates to the cost of your mortgage.

Keep in mind that these concepts apply whether you’re purchasing or refinancing. And different situations will require different considerations.

For example, if you’d like to convert the occupancy type of your second home, investment property, or principal residence, you’ll need to make sure you obtain the proper loan for that conversion.

Also, there are tax-related considerations related to occupancy types that you’ll want to be aware of. So we highly recommend that you talk to a tax professional about the tax implications of the occupancy type of your property.

Otherwise, if you have any questions about occupancy types, mortgages, or anything real-estate related, call now at (888) 273-8734 or Schedule a Consultation.